Global bond yields have climbed to levels the world has not seen since 2009 today, ahead of a critical Federal Reserve meeting, sending a signal for what is coming: A crash that everyone is anticipating, under the fear that the rate-cutting cycles in the US and Australia may be nearing their end.

Yields on the Bloomberg Long-Term Government Bond Index have returned to 16-year highs, with money markets confirming this shift. Investors now do not expect further rate cuts from the European Central Bank, while instead betting on a near-certain rate hike this month in Japan and two 0.25% hikes next year in Australia.

"The disappointment is developing across a lot of developed markets," said Robert Tipp, Chief Investment Strategist and Head of Global Bonds at PGIM Fixed Income. In simple terms, something "bad" seems to be brewing in the financial system.

Warning signs before the crash

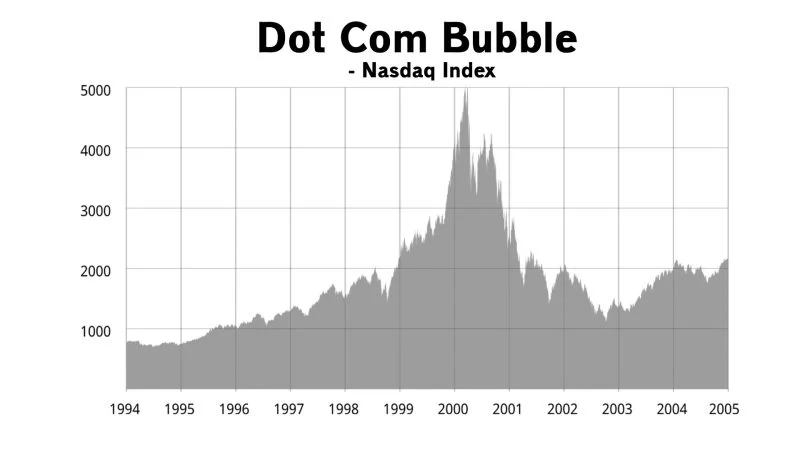

"Stocks have reached a permanently high plateau." "Property prices never fall." "This time is different." These are the sure statements that, time and again, have been heard just before market collapses. Market uptrends and downtrends are nothing new. From the Tulip Mania in the Netherlands to the railway bubble, from the dot-com boom to memecoins, the story is the same: human psychology is vulnerable. We want to believe that there is such a thing as easy money.

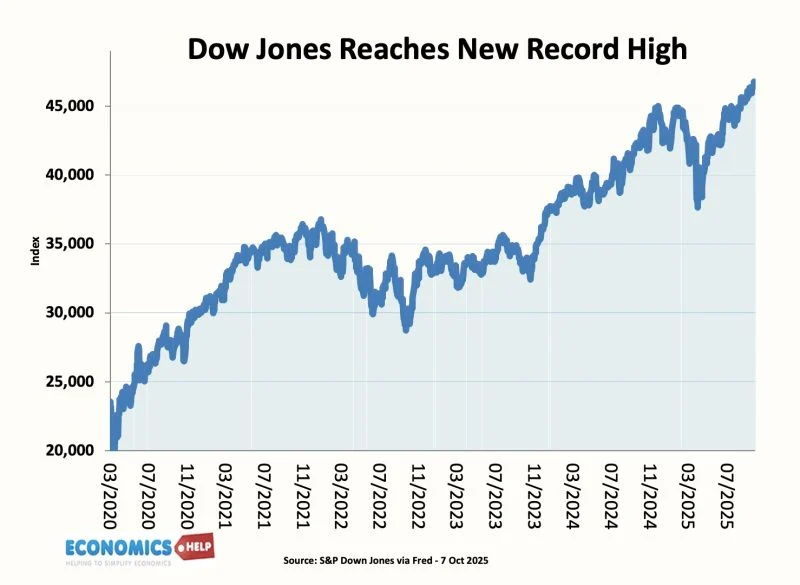

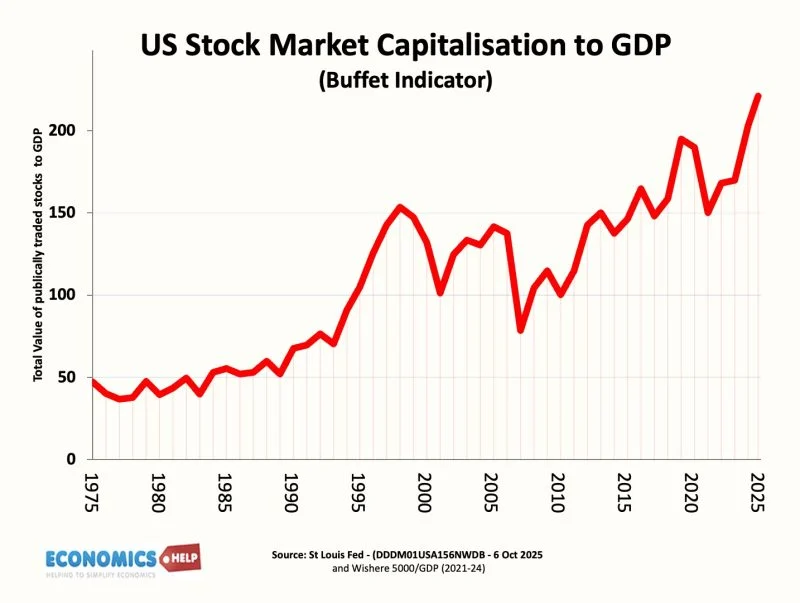

And yet, right now, Wall Street is saying: Crash? What crash? Since the tariffs shock in April, US stock prices have soared by 25%, pushing the total market value relative to the economy—market capitalization as a percentage of GDP—to the highest level ever recorded. If there are economic difficulties, Wall Street seems not to have noticed.

The warning

However, there is a warning. Warren Buffett had said that a market cap to GDP ratio of 70% was a good time to buy. Anything close to 200% signaled a "red" alarm—as we saw in 1999 before the dot-com crash and 2007 before the financial crisis. 221% is quite high.

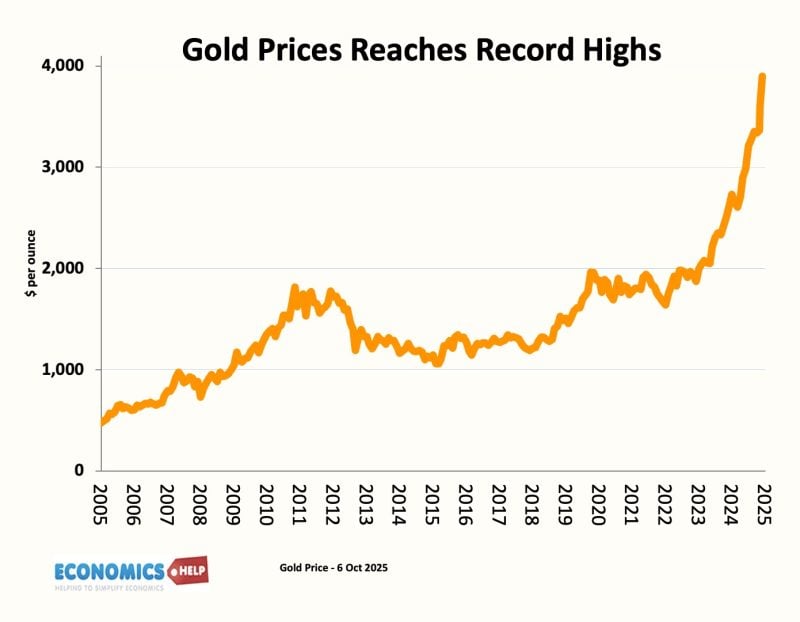

The question is, are we repeating history? It has been a different year. Gold has reached historical highs. The dollar has fallen by 10%. There are real fears of stagflation and concerns about the dollar's long-term decline. And yet, stocks continue to rise.

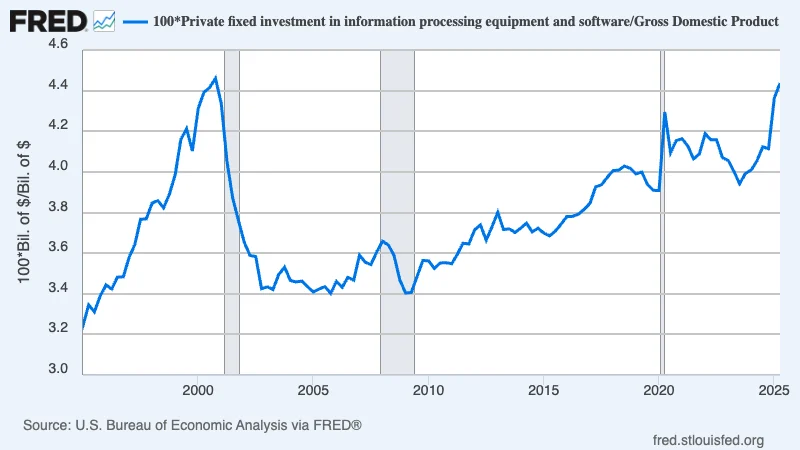

Why? Some argue that the rise reflects a greater money supply, untold wealth at the top, and increasing inequality. Others say it is due to the new miracle technology: Artificial Intelligence. Silicon Valley prophets tell us that AI will transform productivity and increase GDP. But is this a bubble that will burst?

What happens before a crash?

New technology

One of the things that often happens before a crash is that people get excited about a new technology. The new technology can cause a wave of speculation that drives values to incredible levels. At the end of the 1990s, many said that the Internet had revolutionized the rules of business, and this time was different: companies with no profits—sometimes no products—were valued at billions. And indeed, in 2000, the Nasdaq had lost nearly 80% of its value. Although, of course, it recovers over time.

Complex financial products

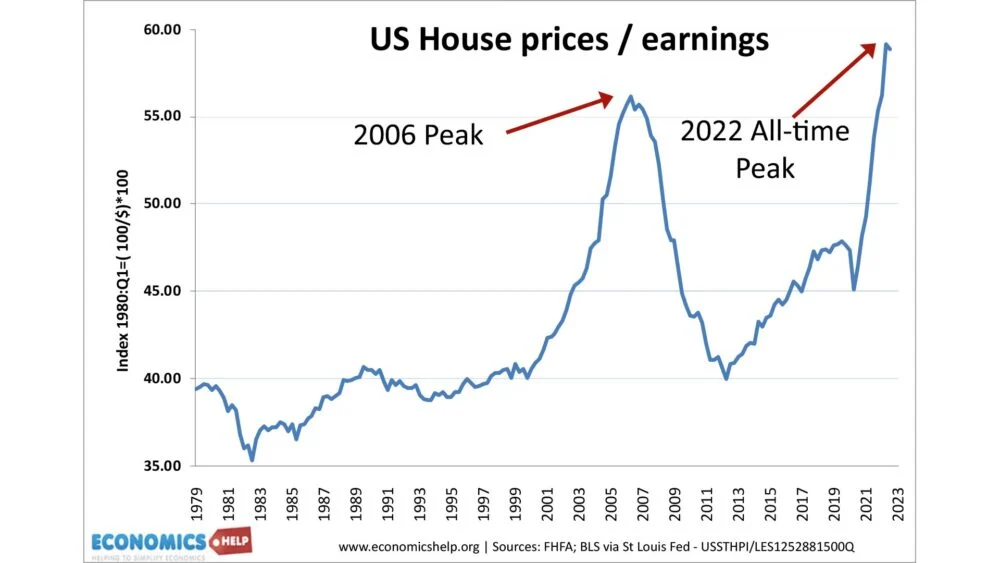

It's not just new technology. In 2006, real estate agents and bankers assured everyone that property prices would only go up. In the US, brokers were lending money to anyone who had a pulse. To boost credit, new financial tools were created, such as credit default swaps and Collateralized Debt Obligations (CDOs). If you didn't understand them, that was the point. They managed to deceive credit rating agencies and banks globally, which completely missed the bad credit hidden in the new products. Two years later, the global financial system was on the verge of collapse.

Regulatory gaps

The financial crisis was characterized by regulatory gaps. The new generation of financial tools emerged from the liberalization of finance. In 2005, Alan Greenspan was congratulating himself on creating low inflation and high growth. But it was a case where he missed the point. You might think that such regulatory failure cannot happen again. After 2008, regulators brought in new regulations for mortgages and bank lending. However, regulators usually fight the last war. Since 2008, new leverage tools have emerged—margin trading apps, complex derivatives, and cryptocurrency lending platforms. Memecoins are the ultimate symbol of bubble psychology.

Fear of missing out

From the Tulip Mania to the property market, when prices rise quickly, a fear of missing out is created. Even the rise in gold prices right now, some claim, is causing people to buy gold who would not normally do so.

Debt growth

One of the great features of economic bubbles is the role of debt in creating excessive growth. In the Southeast Asian crisis of 1997, Asian economies borrowed in US dollars, and any devaluation of currencies made the debt much more expensive.

What do we see now?

Many of these characteristics are present now. However, it is important to remember that the stock market is not the economy. And before a crash, there are usually several years of forecasts before it happens. Global economic growth is slowing, the AI miracle may turn out to be more of a phantom, and governments face a real challenge due to an aging population and swollen fiscal deficits. Furthermore, the US government shutdown may be genuinely serious, indicating the possibility of political division that makes it impossible to bring debt forecasts under control.

www.bankingnews.gr

Σχόλια αναγνωστών