In just one month from the start of the new year, gold rose by almost one third, reaching 5,500 dollars per ounce.

At the same time, the dollar was near a four year low.

The extremely high price of the precious metal has already begun to push away its key buyers.

Will the world’s central banks refuse to buy bullion for their reserves, triggering a collapse in prices.

Gold reached a new all time high at 5,500 dollars per ounce.

At the same time, the dollar is at a four year low.

Such prices may force central banks to refrain from buying gold.

Last year, official purchases fell by 20%, to 863.3 tons, amid a historic surge in prices, and according to the World Gold Council, they are expected to continue to decline this year as well.

Global investment houses cannot keep up with revising their forecasts, gold prices are rising faster.

For example, Goldman Sachs recently raised its forecast for the gold price at the end of 2026 from 4,900 to 5,400 dollars per ounce, while the gold price is already above 5,500 dollars.

Bank of America believes that gold will reach 6,000 dollars per ounce this spring.

The London Bullion Market Association expects levels of both 6,000 and 7,000 dollars per ounce this year.

“The 20% decline in purchases was due to high prices and the rising cost of existing reserves, which reduced interest from the official sector, the central banks.

However, purchases in 2025 continued, the market simply moved from aggressive accumulation to moderate,” said Marina Nikishova, chief economist at Zenit Bank.

Even at such record prices, demand for gold will continue, because the alternative, the dollar and dollar denominated assets, is far worse.

“The aggressive policy of the United States continues to support demand for ‘safe haven’ assets.

Threats of a full scale trade war with Europe, statements by Donald Trump regarding Greenland, the American operation to arrest the president of Venezuela, the criminal investigation against Fed chairman Jerome Powell, all of this frightens the market. Investors are abandoning dollar assets, preferring to invest in commodities, gold, silver, and other metals,” says Nikishova.

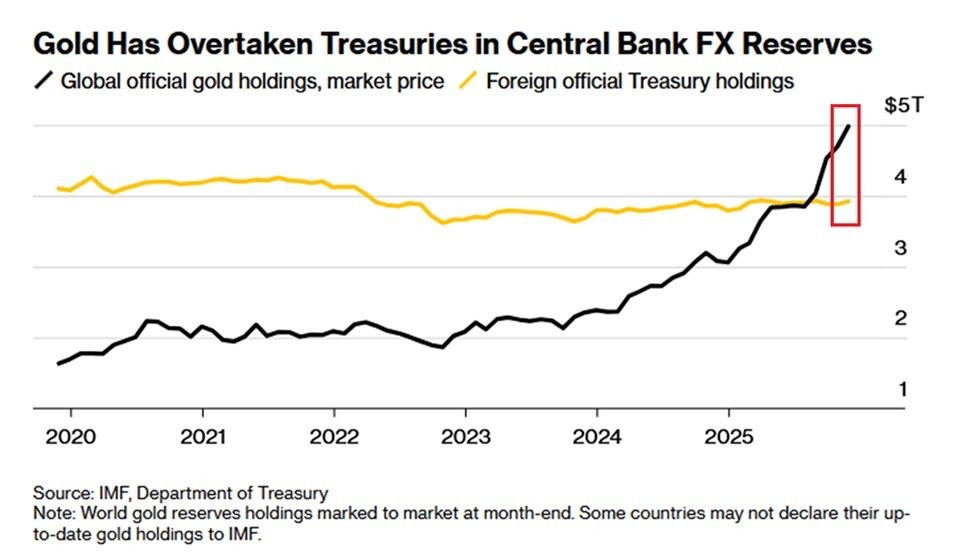

Surpassed the bond market

According to her, the total value of central bank gold reserves by the end of December 2025 approached 4 trillion dollars, surpassing the volume of global investments in US government bonds.

Capital inflows into gold ETFs at the end of 2025 recorded record investments of 88.6 billion dollars, equivalent to more than 800 tons of physical gold.

As a result, gold prices have already increased by more than 27.5% since the beginning of 2026, exceeding 5,500 dollars per ounce, Nikishova notes.

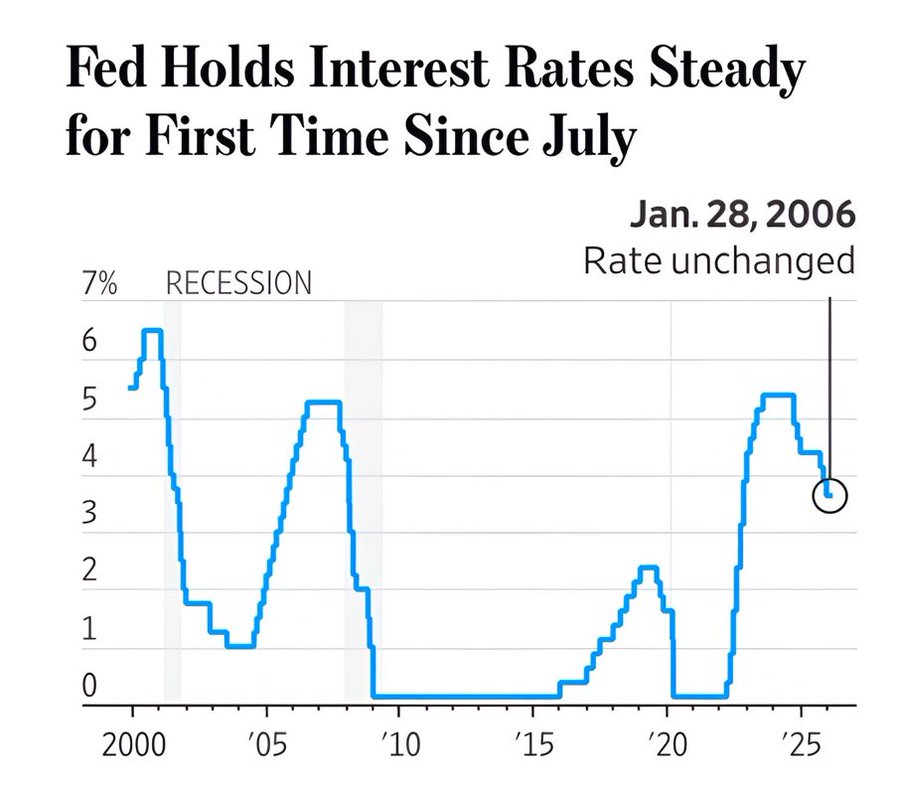

Investor expectations for easing of Fed monetary policy in 2026 are also positive for precious metals.

Interest rate setting by the Fed

Although the Fed kept its rate at the current level on 28 January, the market is betting on two rate cuts during 2026, the expert adds.

According to her, until the geopolitical situation stabilizes and as long as the dollar continues to weaken, the market will not calm down and there is no reason to expect a change in trend. The world’s central banks will continue to buy gold, simply at a more moderate pace.

“A reduction in net purchases by central banks is possible under conditions of peak prices. However, at the speculative and investment level, despite the evident overheating, the price rally in precious metals will continue,” the interlocutor estimates.

At the same time, no one yet expects an improvement in geopolitics.

Donald Trump states that he “is satisfied with the devaluation of the national currency”.

“US debt is increasing and a weak dollar erodes it, which is beneficial for the current administration.

In the short term this may improve the situation, but in the long term government bond yields will rise, leading once again to an expansion of debt.

Thus, the crisis of confidence in the American government and American assets is worsening,” Nikishova explains.

Central banks, therefore, will not stop buying gold, they will simply turn to more moderate purchases.

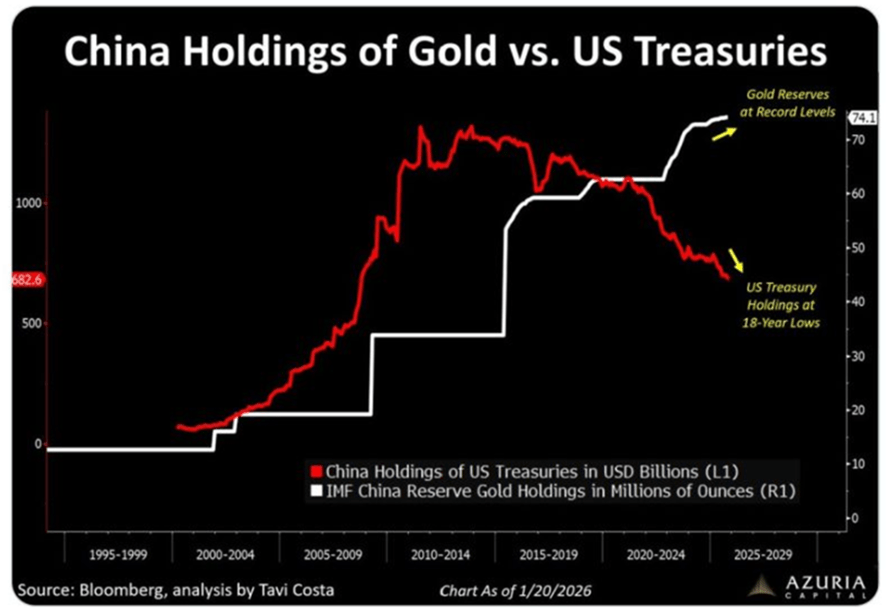

According to the expert, the largest buyer remains the People’s Bank of China, which continues steady monthly purchases of 10 to 20 tons. By the end of 2025, China is expected to remain the largest buyer of the year, says Nikishova.

Second comes the Central Bank of Turkey, which alternates purchases and sales of gold to regulate the domestic market, with a possible positive net result.

Third is the Central Bank of India, which seeks diversification of reserves.

Fourth, gold is also being bought by central banks of OPEC+ countries and Asia, although in smaller volumes.

In the short term, the gold market may appear to be on fire and a correction of around 5 to 10% is possible.

However, the structural factors driving the rise have not disappeared.

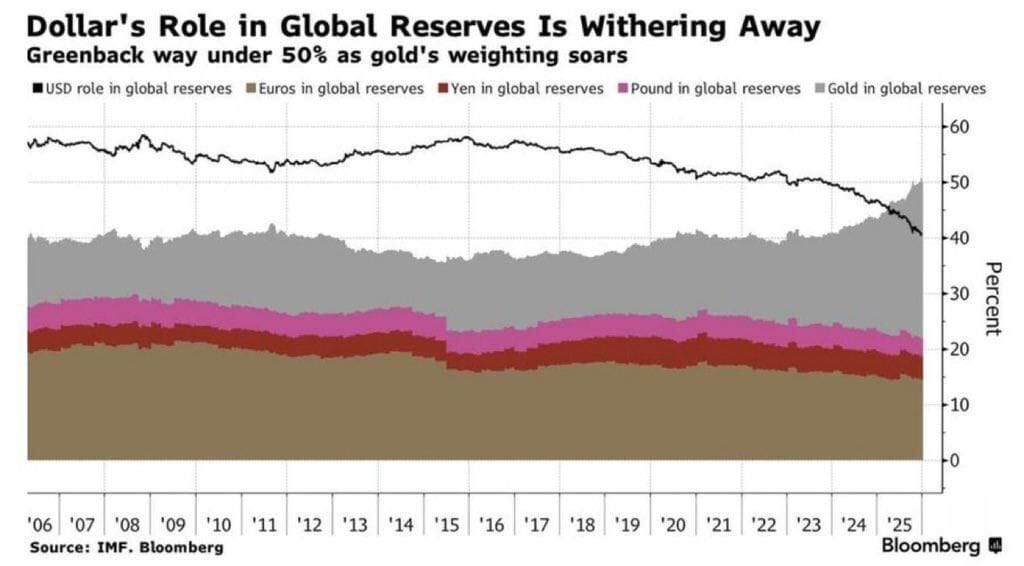

De dollarization and geopolitical instability

On the contrary, they have strengthened over the past two years, with accelerating de dollarization, steady demand from emerging countries, and ongoing global monetary expansion, reports Yulia Khandoshko, CEO of the European brokerage house Mind Money.

Under these conditions of geopolitical instability, gold is expected to continue its upward trajectory in the long term and may soon even reach 6,000 dollars per ounce, estimates Khandoshko.

Zenit Bank raised its 2026 forecast to 5,800 dollars per ounce.

“Technically, the upward trend continues.

Volatility, however, will increase and corrective moves due to profit taking are inevitable.

Nevertheless, corrections will be short lived as long as geopolitics remains a decisive factor and can be used to build new positions,” concludes Marina Nikishova.

www.bankingnews.gr

Σχόλια αναγνωστών