After United States forces abducted Nicolas Maduro in a bold nighttime raid on 3 January 2026, President Donald Trump began pressing oil companies to invest in Venezuela’s heavily corroded oil industry.

The United States president enthusiastically urged drilling companies to invest in Venezuela, which holds the largest proven oil reserves in the world, under the protection of Washington.

However, these overtures received a lukewarm reception from energy companies in the United States and Europe.

ExxonMobil Chief Executive Officer Darren Woods described Venezuela as uninvestable, provoking Trump’s anger, although some energy giants expressed more positive views without making commitments.

Production and flagship fields

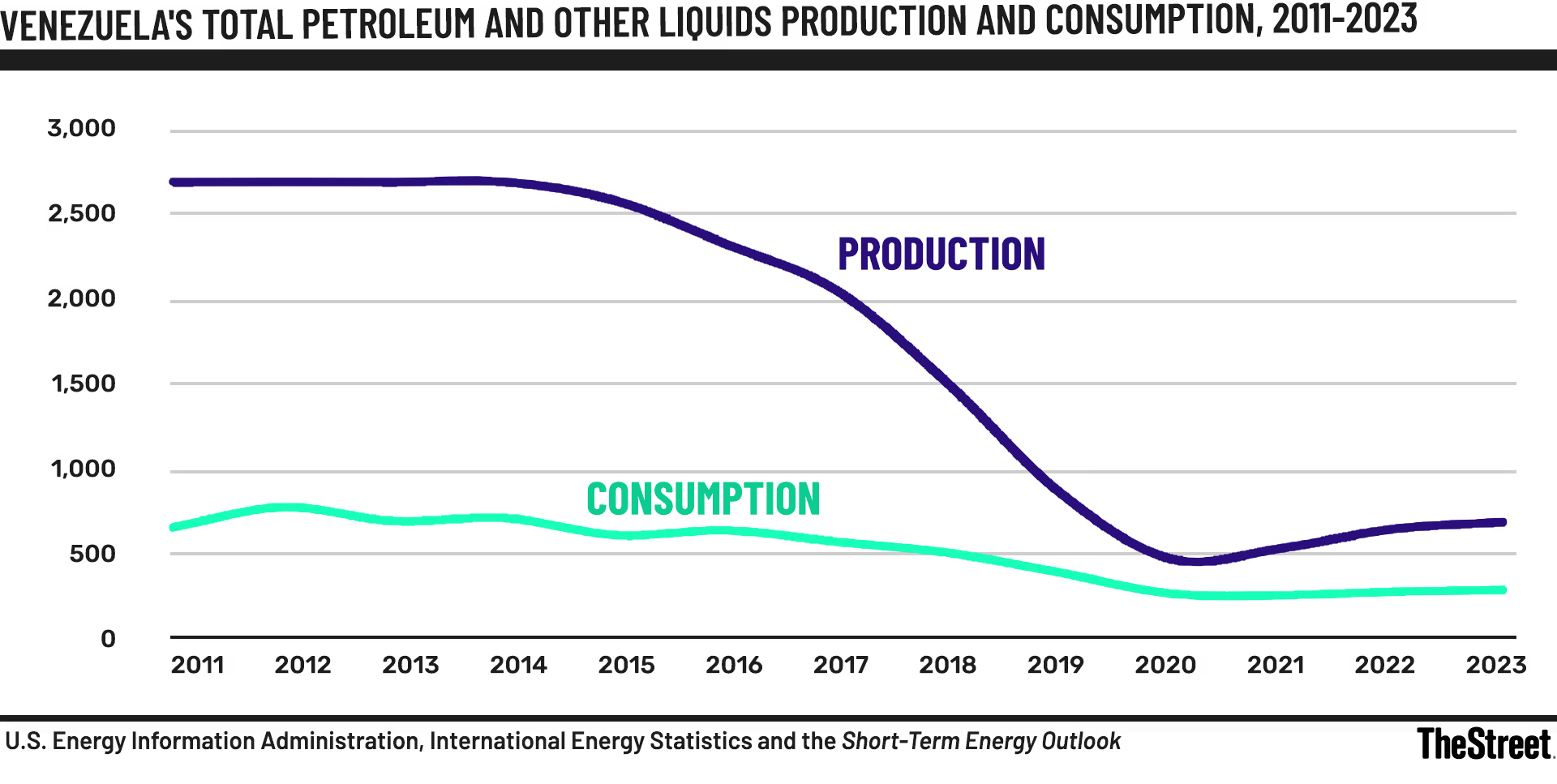

There was a time when Venezuela, once a steady ally of the United States and a bulwark against communism in Latin America, produced more than 3 million barrels of crude oil per day.

Production reached a historic high of 3,754,000 barrels per day in 1970.

Billions of dollars in investment by major United States oil companies to develop the country’s vast reserves, exceeding 300 billion barrels, led to this impressive rise.

Even the nationalization of the hydrocarbons sector in 1976 by President Carlos Andrés Pérez, which placed control under the newly created state company PDVSA, did not materially deter foreign investment.

Heavy crude and the Gulf of America refineries

However, this marked a turning point for Venezuela’s oil industry.

Production volumes declined, reaching a multi decade low just below 1.7 million barrels per day in 1985 as global prices collapsed. Nevertheless, in the early 1990s production rose again when companies from the United States and Europe boosted investment after regulatory easing by Caracas.

In 1997, production reached nearly 3.5 million barrels per day, two years before Hugo Chávez assumed the presidency and launched the socialist Bolivarian Revolution.

Venezuela’s heavy crude oil was particularly popular at refineries along the United States Gulf Coast. Geographic proximity and a deep discount relative to Brent and West Texas Intermediate benchmarks made refining highly profitable despite higher technological requirements. This led to extensive refinery upgrades and construction during the 1970s and 1980s.

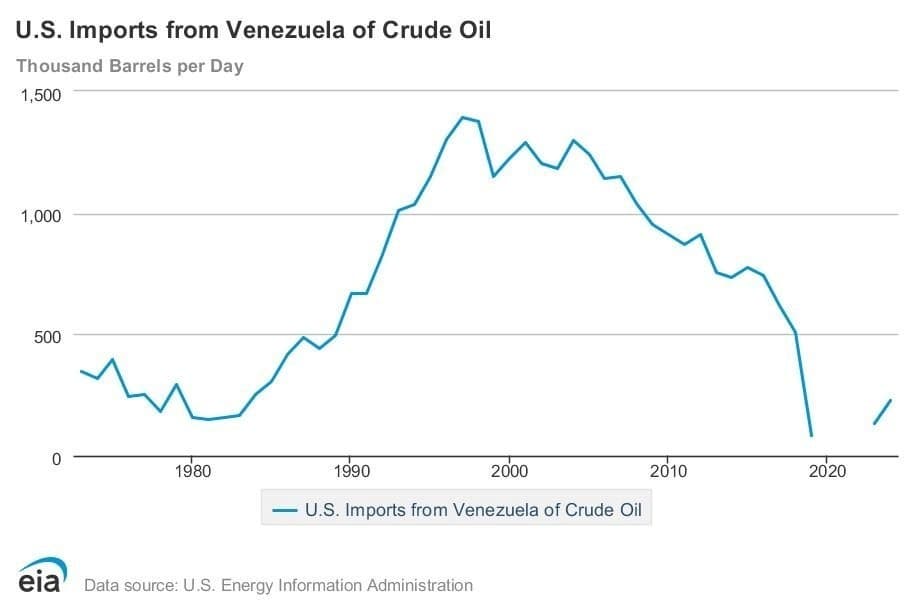

From the 1980s onward, growing volumes of Venezuela’s heavy crude were exported to the United States.

Shipments exceeded 1 million barrels per day in 1993 and reached a historic high of nearly 1.4 million barrels per day in 1997. The United States became the primary export market and the main beneficiary of the country’s oil boom.

Nationalization under Hugo Chávez

The rise of Hugo Chávez to power in 1999 marked the beginning of the decline of the oil sector.

The nationalization of foreign assets, including operations of United States companies, cost billions to firms such as Exxon and ConocoPhillips.

By 2020, production had collapsed to a historic low of 500,000 barrels per day, due to sanctions, chronic mismanagement, corruption and the dismantling of infrastructure.

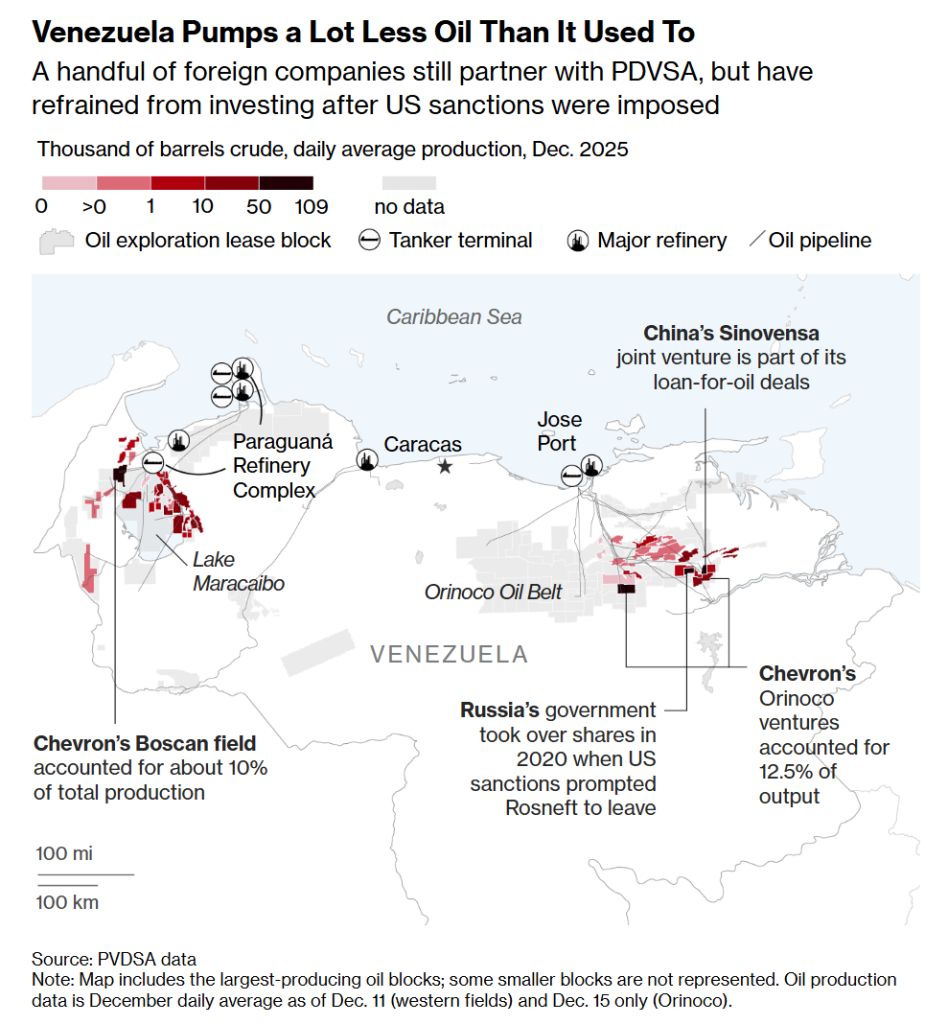

Although investments from China and Iran, as well as a special license to Chevron, slightly increased output, it remained around 1 million barrels per day in 2025, according to OPEC.

Professor Francisco Monaldi, director of the Latin America Energy Program at the Baker Institute of Rice University, estimates that investments of 10 billion dollars annually for a decade are required for production to return to historic highs.

Eyes on Wall Street as Exxon Mobil and Chevron weigh risks

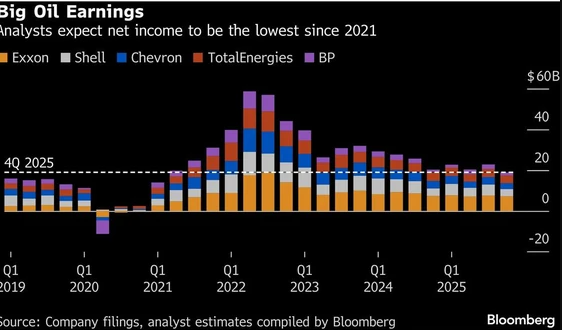

Exxon Mobil Corp. and Chevron Corp. are proceeding carefully as they weigh American President Donald Trump’s call to invest 100 billion dollars to rebuild Venezuela’s oil industry, against the disciplined spending model that has driven their shares higher on Wall Street.

The chief executives of both companies highlighted long term opportunities in Venezuela, which on paper holds the world’s largest reserves, but after announcing their results on Friday appeared reluctant to commit new capital.

They said political and legal reform is required to protect their investments, and stressed that any new projects would have to compete with other investment opportunities worldwide, according to Bloomberg.

Funding from existing assets

Chevron, the only major American oil company currently operating in Venezuela, plans to fund its activities in the country with cash from existing assets, meaning it could increase production by up to 50% without drawing on its global capital budget.

“Expect us to remain focused on value and capital discipline,” said Chief Executive Officer Mike Wirth on a call with analysts.

“It is a large resource that has the opportunity to become a more significant part of our portfolio in the future. But we need to see stability in the country.

We need confidence in the fiscal framework.”

The license from the United States Treasury

Earlier this week, Venezuela’s interim president approved historic changes to the country’s nationalist oil policy that will cut taxes and allow greater ownership by foreign oil companies, less than one month after the arrest of long time leader Nicolas Maduro by American forces. Shortly thereafter, the United States Treasury Department issued a general license expanding the ability of American companies to export, sell and refine crude originating from the sanctioned South American country.

Darren Woods, Chief Executive Officer of Exxon, who had irritated Trump after calling Venezuela uninvestable at a White House meeting earlier this month, adopted a more positive tone on Friday (30/1), praising the administration’s efforts to improve Venezuela’s legal and fiscal framework. He stressed, however, that this would take time.

“What I said at the White House was that, based on the current fiscal and legal structures, you could not invest, but there were ways to address that,” Woods said. “The Trump administration has committed to doing that.”

Woods also added that the country would need more democratic representation, something that, he said, the Trump administration has not yet focused on.

Exxon’s stock on Friday (30/1) saw modest movement, but during the week touched a historic high, as investors rewarded the oil giant for strong growth in low cost production from Guyana and the Permian Basin, which helped offset falling crude prices and reduced the company’s need to invest in Venezuela.

Chevron shares rose 3.3%, as the company cut costs, increased its dividend and boosted production.

Fiscal regime and political stability

Venezuela “is a tangible growth lever for the company, given that its assets have been maintained at performance levels while competitors exited the country,” James West, an analyst at Melius Research, said in a note.

“However, the scale of production still depends on the fiscal regime, regulation and political stability.”

Chevron will use early profits from Venezuela to recover debts owed by state company Petroleos de Venezuela SA and to cover routine operating costs, such as well workovers and maintenance on pumps, pipelines and compressor stations.

The company currently produces about 250,000 barrels per day from joint ventures it shares with PDVSA, an amount equal to roughly 2% of Chevron’s annual cash flows.

Changes to Venezuela’s hydrocarbons law approved this week are a step in the right direction, Chief Financial Officer Eimear Bonner said in an interview. However, she added that Chevron will require additional approvals from the United States Treasury Department to achieve the planned 50% production increase.

Another challenge is Venezuela’s heavy oil, which is highly viscous and does not flow easily.

Exxon’s Woods compared it to Canada’s oil sands, where the company has an approach that will lead to lower production costs.

The biggest obstacle, however, is ensuring that any future investment is legally and politically secure.

Exxon has seen its assets nationalized in Venezuela both in the 1970s and in the mid 2000s.

“They changed the rules of the game,” Woods said in an interview with CNBC.

“It is a very slippery slope once you start partnering and working with people who steal from you.”

www.bankingnews.gr

Σχόλια αναγνωστών