As gold prices have surged by over 230% since 2020, central banks worldwide have embarked on one of the largest buying waves in modern history. The precious metal no longer functions solely as a risk hedge but is returning as a strategic reserve tool amidst geopolitical tensions, monetary instability, and intensifying diversification away from the dollar.

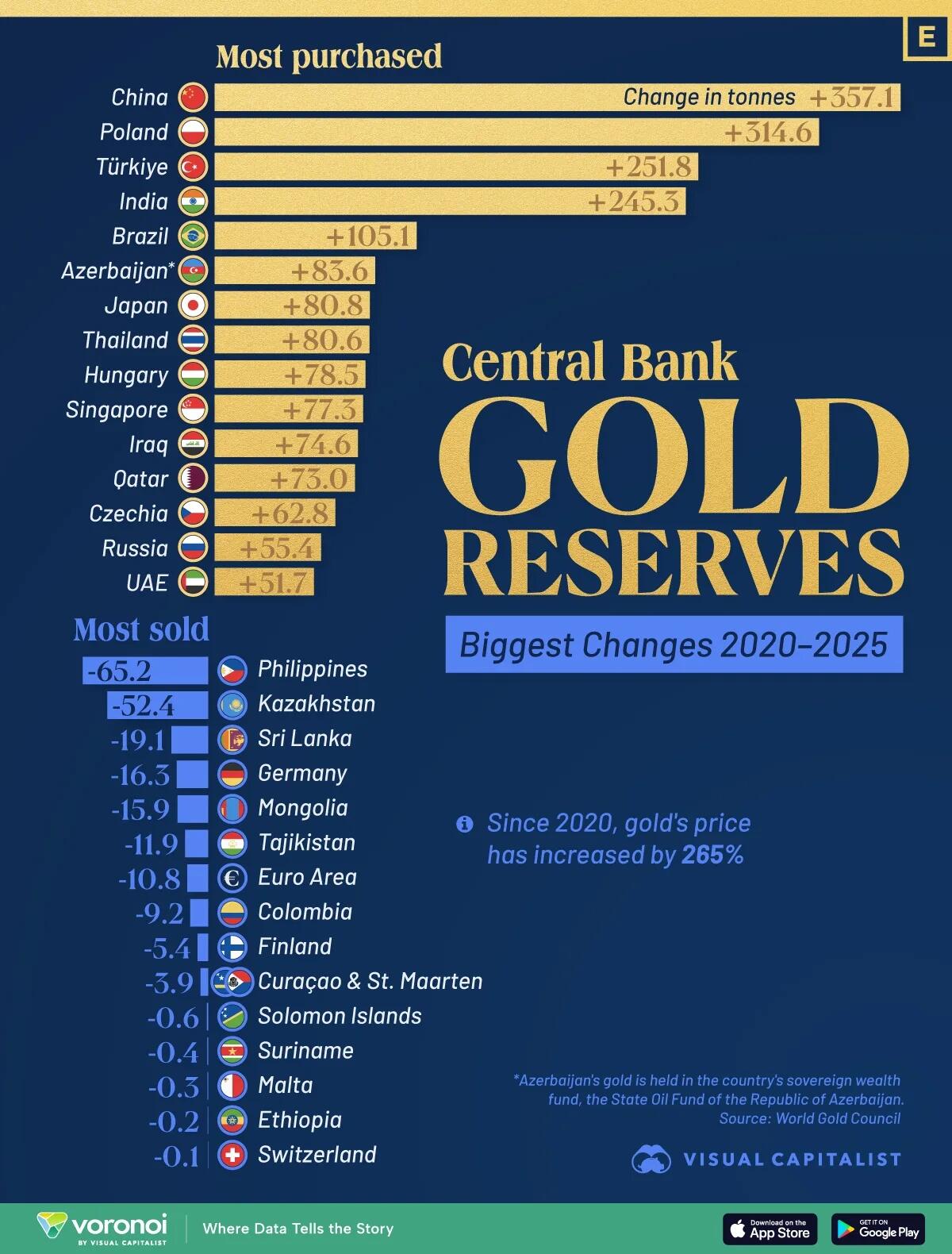

According to data presented by Visual Capitalist through an analysis by Niccolo Conte, the 15 largest buyers added nearly 2,000 net tons of gold over the last five years, confirming a strategic shift within the official sector.

China and Eastern Europe at the forefront

China recorded the largest net increase, boosting its reserves by more than 350 tons. This move is part of Beijing's long-term strategy to limit dollar dependence and reduce exposure to Western financial systems, with gold acting as a "politically neutral" pillar of reserves. Poland followed with an increase of over 300 tons as part of an effort to bolster its monetary security. Turkey and India also ranked among the top buyers—economies facing inflationary pressures and exchange rate volatility, making gold an attractive stabilization tool.

Emerging markets strengthen reserves

Brazil added over 100 tons, while Azerbaijan increased its holdings through the State Oil Fund of the Republic of Azerbaijan. Simultaneously, Japan, Thailand, Hungary, and Singapore also proceeded with purchases, confirming the broader international interest in gold as a "safe haven" during periods of economic uncertainty.

Those who reduced reserves

Conversely, certain countries reduced their holdings. The Philippines recorded the largest decrease, exceeding 65 tons. Kazakhstan and Sri Lanka also proceeded with significant sales, often due to liquidity pressures or reserve restructuring. To a lesser extent, Germany and Finland trimmed their reserves, while Switzerland recorded a marginal change, maintaining its historically stable approach to gold management.

Strategic return of gold

Overall, the data underscores that gold has made a dynamic comeback as a cornerstone of international reserves. Although strategies differ from country to country, the broader trend indicates that states are preparing for a more uncertain and multipolar monetary environment, where diversification and resilience take a leading role.

www.bankingnews.gr

Σχόλια αναγνωστών